Small auto parts companies face rising local sourcing pressure as procurement costs grow across global markets. Many small distributors depend on local wholesalers. However, those wholesalers often set higher prices due to low volume, limited supply, and regional dependence. As a result, small businesses struggle to stay competitive, even though demand for passenger car parts continues to rise in 2025.

Industry observers at Automotive News note that more micro distributors enter the market each year, yet most remain trapped in local supply chains due to lack of capital, licensing barriers, and import expertise(source: www.autonews.com). Additionally, McKinsey highlights that local suppliers tend to keep margins high because small distributors cannot source directly from manufacturers(source: www.mckinsey.com)。Consequently, the pressure grows for micro and small players.

Although demand increases steadily, many small companies hesitate to import parts directly. First, import procedures remain complex for new entrants. Duties vary by region. Documentation requirements are strict. Freight consolidation is often difficult for low-volume buyers. Furthermore, incorrect HS coding, unverified suppliers, and unstable logistics create more risks. Because of these issues, many micro distributors rely on local vendors and ultimately pay more.

However, global supply chain trends show a shift. More regions open opportunities for small importers. For example, e-commerce-based B2B sourcing makes direct procurement safer and more transparent. Additionally, reliable exporters provide mixed-model shipments and flexible MOQ solutions. Therefore, small businesses can now explore alternative sourcing methods that reduce cost pressure.

Moreover, passenger car parts demand keeps rising in Asia, Latin America, Africa, and Eastern Europe. Replacement cycles shorten. Customers prefer affordable yet reliable components. As demand grows, micro distributors must reduce dependency on high-priced local wholesalers. Otherwise, they risk losing customers to larger competitors who already import directly.

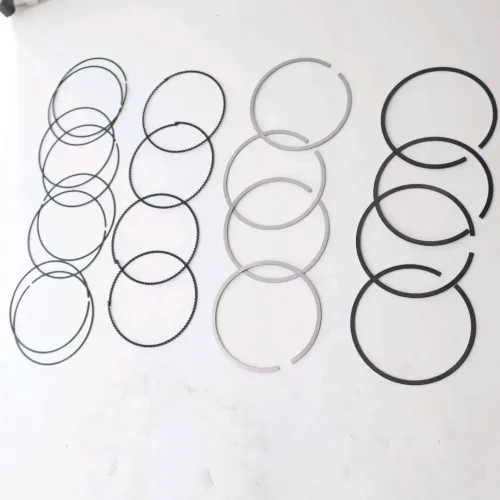

At the same time, global suppliers now provide stronger support. Bilink offers structured sourcing guidance, stable quality control, and packaging consolidation. These services reduce import risks for small enterprises. Additionally, we help distributors identify fast-moving items such as lighting, filters, and chassis parts. For example, our recommended product today is the Combination Tail Lamp for Tank 300, a stable and cost-efficient replacement part suitable for diverse markets:

👉 https://bilinkglobal.com/product/combination-tail-lamp-4133100xkm13a-gwm-tank-300/

Furthermore, small distributors can follow public trade insights from sources like OECD Trade Outlook or World Bank Logistics Performance Index to understand tariff changes and freight capacity(e.g., www.oecd.org and www.worldbank.org)。These insights help reduce sourcing risks and improve planning.

Although challenges remain, small auto parts companies now have more options. Bilink supports global micro distributors with mixed-container shipping, warehouse consolidation, and component verification. These services build trust and enhance long-term cooperation. We remain committed to helping global partners lower costs and strengthen their competitive edge in 2025.

Bilink provides consistent quality, reliable inspections, and flexible supply options for global auto parts distributors. Our export network supports importers with stable sourcing, efficient logistics, and trusted product verification. We commit to long-term cooperation and help partners reduce procurement risks while improving market competitiveness.

Related Post